A business plan is a written document that details your company’s financial objectives and describes how you’ll meet them. A solid, thorough plan will offer a roadmap for the company’s upcoming three to five years, and you can share it with prospective investors, lenders, or other significant partners.

Below is a step-by-step guide for writing your business plan

Compose an executive summary

This is the first page of your company’s strategy. Think of it as your elevator pitch. A statement of purpose, a brief description of the goods or services offered, and a general outline of your financial expansion strategies should all be included.

Even though your investors will read the executive summary first, writing it last may be easier. This will allow you to highlight important details when writing more detailed sections in subsequent sections.

Describe your business

The following section is a description of your company, and it should include information such as:

- Your company’s registered name

- Your company’s location

- Key business figures’ names

Your company description should also include its legal structure, such as sole proprietorship, partnership, or corporation, as well as each owner’s percentage of ownership and level of involvement in the business.

Include the history of your company as well as the current state of your industry. This prepares the reader to read about your objectives in the section that follows.

Outline your company’s goals

In a business strategy, an objective statement ranks third. You clearly state your short-term and long-term goals in this section.

If you’re seeking a business loan or outside investment, this section can be used to justify why you need the money, how the money will help your company grow, and how you plan to meet your growth goals. The goal is to clearly explain the opportunity and how the loan or investment will aid in the growth of your company.

Describe your goods and services

Provide specifics about the goods or services you provide or intend to provide in this section.

The following should be included:

- A description of your product or service’s operation.

- Your product or service’s pricing structure.

- The typical clients you deal with.

- Your order fulfillment and supply chain management.

- Your sales strategy.

- Your distribution strategy.

You can also talk about any registered or pending trademarks and patents related to your products or services.

Conduct market research

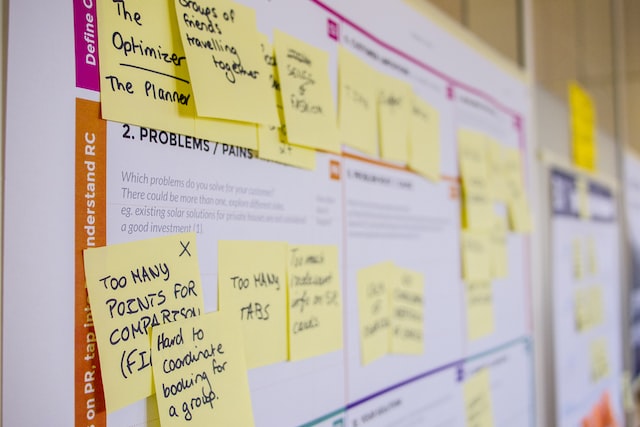

Investors and lenders will be interested in learning how your product differs from the competition. In the market analysis section of your paper, identify your competitors. Talk about what they do well and how you can improve. Indicate whether you are catering to a niche or underserved market.

Explain your sales and marketing strategies

You can discuss your strategies for persuading customers to buy your products or services or for cultivating repeat business here.

Conduct a company financial analysis

If your company is still in its early stages, you may not be familiar with its financials. Even if your company is well-established, you should still include income or profit-and-loss statements, a balance sheet that lists your assets and liabilities, and a cash flow statement that shows how cash enters and exits the business. You could also incorporate metrics like;

- Net profit margin: the percentage of revenue retained as net income.

- Current ratio: this ratio is used to assess your liquidity and debt-paying capacity.

- Accounts receivable turnover ratio: a measure of how frequently receivables are collected on an annual basis.

This is an excellent place to include graphs and charts that will help readers quickly understand the state of your company’s finances.

Make financial projections

This is a must-have component of any business plan if you’re looking for funding or investors. It explains how your company will make enough money to repay the loan or provide investors with a reasonable return.

You’ll give projections of your company’s monthly or quarterly revenues, costs, and profits for the next three years, assuming you’ve gotten a new loan.

Examine your previous financial accounts carefully before making projections because accuracy is critical. Your goals should be aggressive while also attainable.